Understanding a stopping order: a comprehensive guide for the cryptocurrency traders

In a quickly developing currency world, a fundamental concept is crucial for the successful and profitable execution of crafts. One such concept is the order of stopping, which plays a vital role in managing risk and restricting potential losses. In this article, we will enter the basics of stop commands, their importance in the cryptocurrency store and how to use them effectively.

What is the stop command?

The stop order is the instructions that the merchant gives for the sale or purchase of a particular crypto currency at a predetermined price level, regardless of market conditions. This is basically a “stop” mechanism that sets the price for a trade, preventing the merchant to make significant losses if the market starts against them.

Why use stopping orders?

Stopping orders are useful in several ways:

- risk management : By setting up a stop order at a predetermined price level, traders can limit their potential losses and prevent significant decline in values.

- Price protection : Stopping orders ensure that the trader is protected from the instability in the market, allowing them to conclude profit or use favorable prices.

- Store execution : Stop the orders facilitate the smooth execution of trade by providing a outlet strategy for traders who want to limit their exposure to potential losses.

How do stop stop orders?

Here’s a detailed guide on how to do stop commands:

- Award : A merchant assigns a stopping order with broker or exchange, citing cryptocurrency currency, price level and all additional conditions.

- Execution : The store is executed at a specific price level, provided that it meets all the market requirements (eg sufficient liquidity, the availability of data in the market).

- Warnings

: When a stop order is initiated, the warning is sent to the phone or E -the trader, indicating that the store was entered.

Stopping types

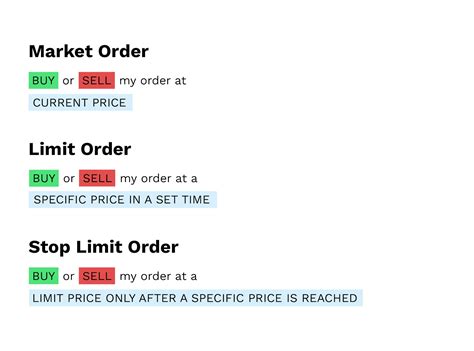

There are three basic types of stopping order:

- A market order with stop (moss) : a market order with stopped at the current market price.

- Limited stop with stop (loss) : limited order with stops set below or above the entrance price, depending on the type of order.

- ORDER TO STOP LIMITION : Combination of market and limited orders with a fixed price level between which it can enter the store.

Using a stopping order in a cryptocurrency trading

To successfully use a stopping order in cryptocurrency trading:

- Identify key prices : Watch out significant price levels, such as key support or resistance zones.

- Set up more stops : Set up more stops at different price levels to protect your profit and limit potential losses.

3

Best Practice to use a stopping order

In order to maximize the efficiency of stop commands:

- Use more stops : Combine more stops to create a “stop” strategy.

- Set Alerts : Set alerts for breach or market conditions that can start your stopping order.

- Follow and customize : Continuously monitor your stores and adjust your stopping orders as needed.

Conclusion

Stopping orders are a key tool at the cryptocurrency store, providing traders flexibility to manage risk and restriction of potential losses. Understanding how they stop orders and use them effectively, traders can achieve greater success and stability in the market. Remember to keep more stops, set warnings and continuously monitor your stores to maximize their effectiveness.

Leave a Reply